The term ‘Cash Cow Matrix’ in the BCG framework represents a cornerstone of strategic business management, offering a clear pathway to sustained financial health and strategic advantage. Understanding this concept is crucial for businesses aiming to maximize their market potential and ensure steady revenue streams.

Cash Cow Definition:

Cash cows are products, product lines, brands or companies that are able to retain significant shares of their market and have consistently good returns. This is often the case in a mature or established industry with slow overall growth. The expression itself is a metaphor from the financial sector and can describe ventures or investments that can generate substantial income. It’s also part of the Boston Consulting Group (BCG) growth matrix, which defines products as belonging to one of four categories and is useful for company planning.

What is the Cash Cow Matrix?

In the realm of business strategy, a cash cow refers to a product or business unit that consistently generates more cash than it consumes. This quadrant of the Cash Cow Matrix is characterized by high market share in a slow-growing industry, making these units stable sources of revenue with minimal investment required for maintenance.

Characteristics of the Cash Cow Matrix

Low Investment, High Return: Cash cows require little investment to maintain their market position, yet they produce a high return on assets, which is vital for funding other business ventures or innovation within the company.

Steady Revenue Stream: Due to their dominant market position, cash cows provide a reliable and steady income stream, allowing businesses to plan long-term strategies with greater financial security.

Financial Stability: The surplus revenue generated by cash cows can be crucial in supporting a company’s overall financial health, providing the necessary capital to buffer against market fluctuations or invest in new opportunities.

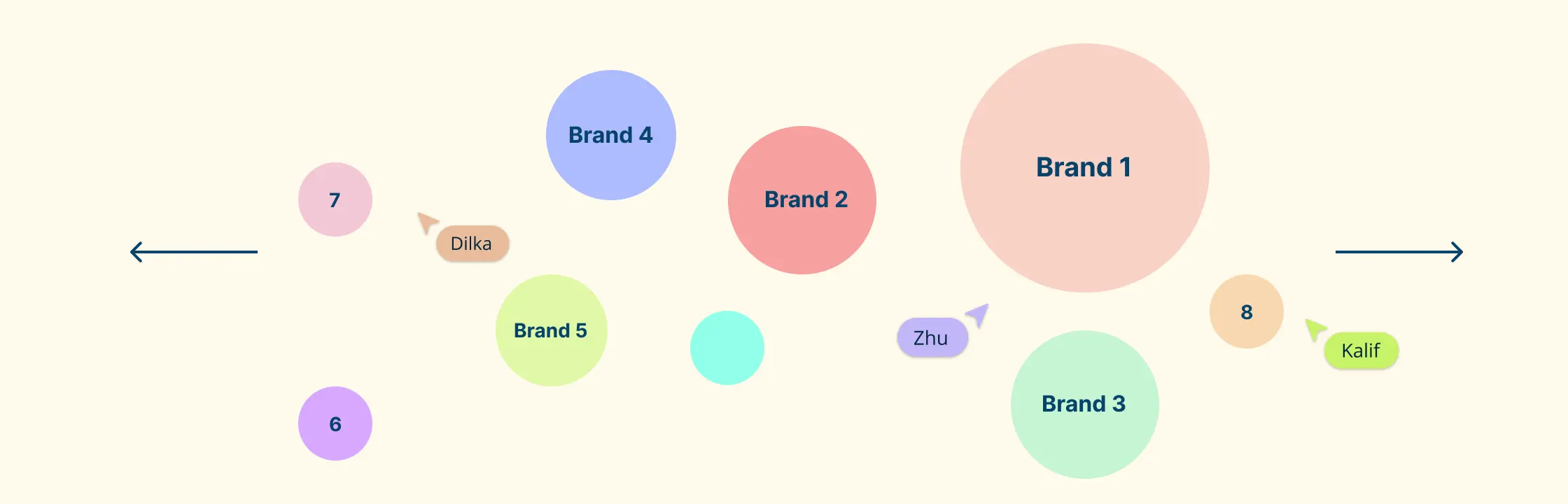

Understanding the distinction between cash cows and other categories in the cash cow matrix, such as Stars, Question Marks, and Dogs, is essential. Unlike these other categories, cash cows are the financial pillars that support sustained growth and stability within a company. They are the bedrock upon which risky ventures can be tested and new markets explored without jeopardizing the core business operations.

Benefits of Understanding The Cash Cow Matrix

The BCG Matrix is not just a theoretical model; it offers practical benefits in real-world business applications:

- Strategic clarity: It provides a clear visual representation of where each business unit stands, aiding in strategic clarity and decision-making.

- Resource allocation: Helps in prioritizing investments among different business units, focusing on potentially lucrative areas like Stars and Cash Cows.

- Long-term planning: Facilitates effective long-term planning by identifying potential growth areas and units that may require divestiture.

For comprehensive strategic analysis, integrating the BCG Matrix with other tools can be beneficial. Explore options like Grand Strategy Matrix Template for a broader strategic perspective.

How the Cash Cows Matrix Affects Business Strategy

The strategic importance of cash cows in the BCG matrix cannot be overstated when it comes to business growth and financial health. These business units, characterized by their ability to generate more cash than they consume, are pivotal in funding and sustaining a company’s broader strategic initiatives.

Funding and Investment Decisions

Cash cows provide the financial backbone for a company, allowing for the allocation of capital to other areas with higher growth potential but requiring more investment. This internal funding mechanism is crucial for maintaining a balanced portfolio and supporting the overall business strategy. For instance, revenue from a cash cow can be used to nurture and develop Question Marks into future Stars within the BCG matrix. This strategic reinvestment can be crucial for long-term sustainability and market dominance.

- Strategic reallocation of profits from cash cows to fund R&D and innovation.

- Support for riskier ventures that could potentially become the next big market leaders.

- Financial flexibility to explore new markets or enhance technological capabilities

Sustainability and Long-term Planning Using Cash Cows in BCG Matrix

Long-term planning and sustainability are enhanced by the stable revenue streams from cash cows. These units help businesses weather economic downturns and invest in long-term growth strategies without the immediate pressure of financial return. This aspect of the BCG matrix encourages companies to think strategically about future positioning and market dynamics.

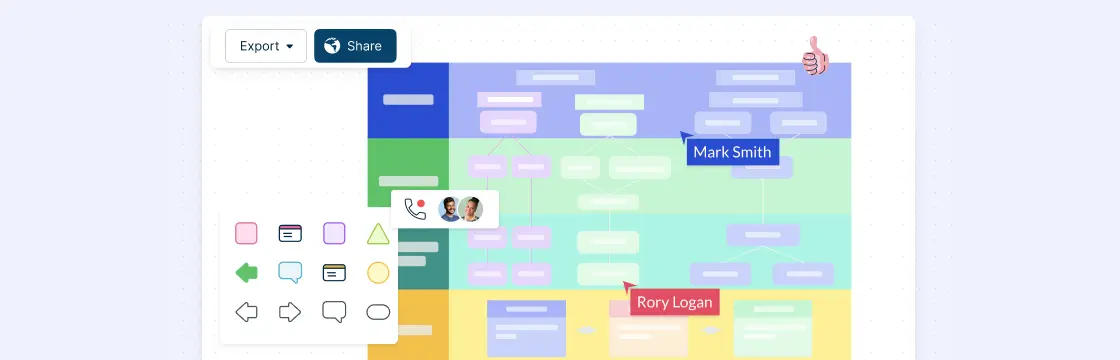

Moreover, tools like BCG Matrix Template can aid in visually organizing and planning these strategies, ensuring that each business unit’s role and potential are clearly understood and effectively managed.

- Ensuring steady cash flow for operational stability and strategic maneuvers.

- Facilitating a proactive approach to market changes and potential disruptions.

- Empowering leaders to make informed decisions based on comprehensive data analysis and market trends. Ultimately, the role of cash cows in a company’s business strategy is to provide both the resources and the flexibility needed to drive innovation and secure a competitive advantage in the market. This strategic approach not only supports current business needs but also sets the stage for future growth and success.

Cash Cow Examples

In the business world, understanding the practical application of concepts like the cash cow in the BCG matrix is crucial. This section delves into real-life examples of cash cows across various industries, providing insights into their management and the impact of market changes on their performance.

Sector-wise Comparative Analysis

When comparing sectors, consumer goods companies often have clear cash cows. These are typically products that have been in the market for decades, commanding a loyal customer base and consistent sales. These products provide the financial backbone for these companies, allowing them to explore new markets and product innovations.

In contrast, in the tech industry, cash cows are often older software or services overshadowed by newer technologies but continue to provide substantial revenue. This revenue is crucial for funding ventures into emerging technologies or markets, as seen in our earlier example.

Understanding these dynamics is essential for any business strategy, and tools like strategic analysis tools can provide the frameworks necessary to analyze and manage these categories effectively.

For more detailed guidance on conducting a thorough competitive analysis, which can highlight potential cash cows within your industry, refer to “How to Do a Competitive Analysis”

Alternative Models to the BCG Matrix

The BCG Matrix has long been a staple in strategic business planning, offering a simple yet effective framework for managing a portfolio of business units. However, the dynamic nature of modern markets often requires more nuanced tools. In this section, we explore alternative strategic planning tools and compare them to the BCG Matrix, helping businesses decide which model best suits their strategic needs.

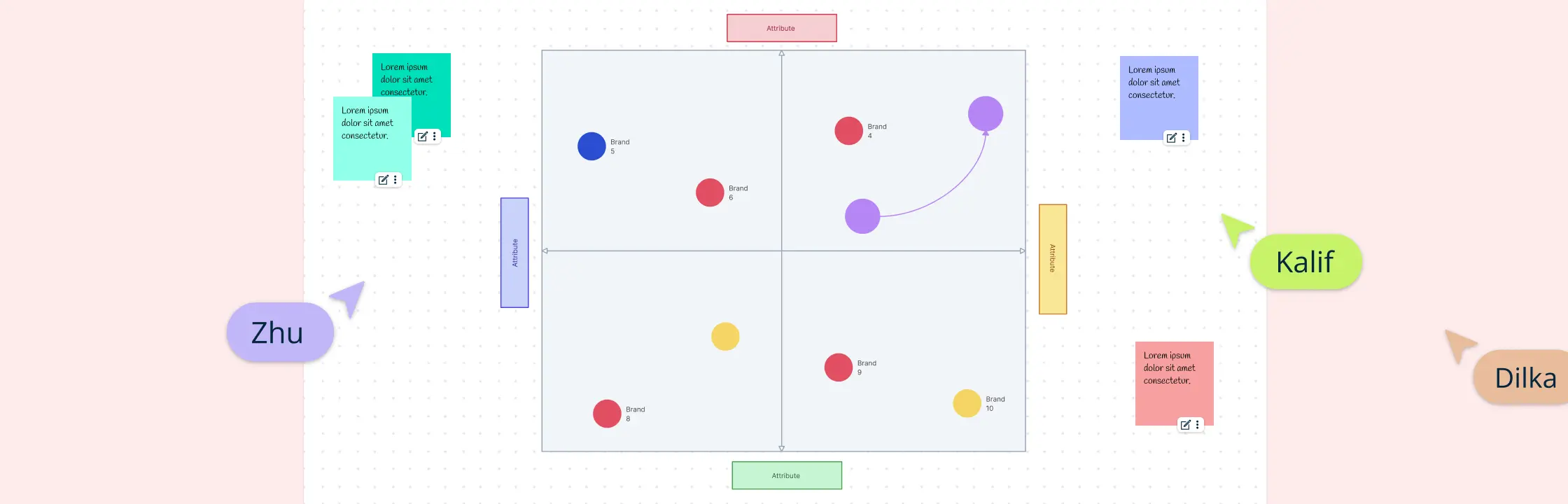

Comparing Strategic Models

While the BCG Matrix categorizes business units into four distinct quadrants, other models like the GE/McKinsey Matrix and the ADL Matrix Template offer different dimensions and criteria for analysis. The GE/McKinsey Matrix, for instance, evaluates business units based on industry attractiveness and competitive strength, providing a more granular view of market dynamics. The ADL Matrix assesses the competitive position and industry maturity, which can be particularly useful for businesses operating in rapidly evolving industries.

Another notable model is the Ansoff Matrix, which focuses on growth strategies through market penetration, market development, product development, and diversification. Unlike the BCG Matrix, which is more about resource allocation based on current performance, the Ansoff Matrix provides strategic options based on potential growth opportunities.

Integrating Strategic Tools

For businesses seeking a comprehensive analysis, integrating multiple strategic models can be highly beneficial. This integration allows for a more robust evaluation of both internal capabilities and external market conditions.

Moreover, platforms like Creately offer advanced features that facilitate the visualization and comparison of these models. With frameworks like Strategic Group Maps and Scenario Planning Templates, businesses can dynamically adjust their strategies in response to market changes, ensuring sustained growth and competitiveness.

In conclusion, while the BCG Matrix remains a valuable tool for portfolio management, exploring and integrating alternative models can provide deeper insights and more tailored strategic actions. This approach not only accommodates the complexities of modern business environments but also leverages the full spectrum of strategic planning tools available.