Navigating the complexities of financial management can be a daunting task, especially when it comes to tracking expenses. This is where expense report templates come into play, serving as a crucial tool for businesses and individuals alike. An expense report template is essentially a preformatted document that helps streamline the process of recording and submitting expenses for approval and reimbursement.

What is an Expense Report?

An expense report is a document that gives a detailed breakdown of expenses incurred by an individual or a company during a specific period of time. It serves as a record of all the expenditures made by an individual or employees of a company while carrying out business activities or performing job-related tasks. Expense reports are typically used for reimbursement purposes, allowing individuals to request reimbursement for the money spent on business-related expenses.

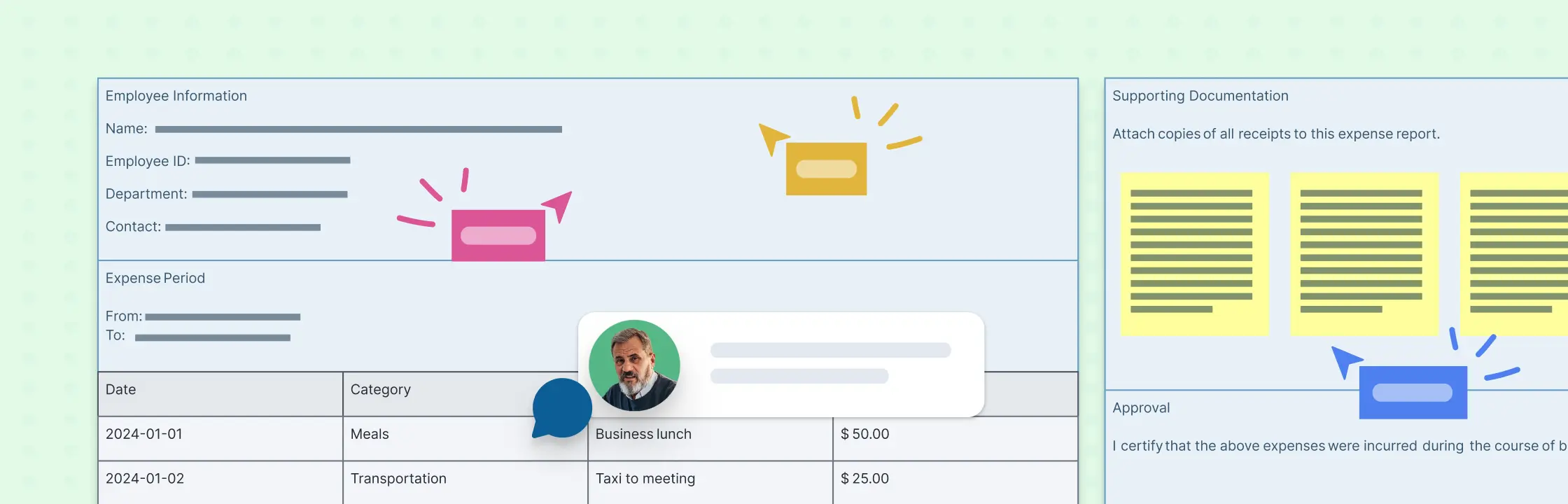

An expense report template is a pre-formatted document that organizations use to track and manage these expenditures. It is a standardized form that simplifies the process of documenting, reporting, and approving expenses. Typically, an expense report template includes fields for date, description, category, and amount of each expense, along with space for any necessary receipts or documentation.

Expense Report Templates

Customize the following expense report templates based on your organization’s specific requirements and policies.

Travel Expense Report Template

Small Business Expense Report Template

Project Expense Report

Annual Expense Report

Employee Expense Report

Event Expense Report

Components of an Expense Report Template

To maintain accuracy and compliance, make sure that these elements are included within the template:

- Date: Every expense must be accompanied by the date it was incurred. This helps in organizing expenses chronologically and is essential for accounting purposes.

- Category: Expenses should be categorized (e.g., travel, office supplies, client entertainment) to simplify budget tracking and reporting.

- Amount: The exact amount spent needs to be clearly stated, as it directly affects the financial statements.

In addition to these elements, two critical components must be included:

- Receipts or proof of expense: Attaching receipts or other proof is necessary to validate the expenses claimed. This serves as an audit trail and is vital for transparency.

- Approval signatures and coding for accounting: Each report should have a section for approval signatures, indicating managerial review and authorization. Furthermore, coding for accounting purposes helps the proper allocation of expenses to the correct budget lines or projects.

These components not only streamline the expense reporting process but also safeguard against inaccuracies and potential misuse of funds.

What is the Use of Expense Reports

Expense reports serve several important purposes for both individuals and organizations.

Reimbursement: Expense reports are submitted to request reimbursement for business-related expenses, facilitating compensation for out-of-pocket costs.

Financial tracking: They help track spending patterns, aiding in budgeting, financial planning, and identification of areas for cost optimization.

Compliance and policy enforcement: Expense reports help make sure employees adhere to company policies on acceptable expenses and spending limits.

Tax purposes: They can be used to track tax-deductible expenses, facilitating tax filing and compliance with regulations.

Audit trails: They create a detailed record of transactions for internal and external audits, maintaining transparency and accountability.

Employee accountability: They foster accountability as employees are responsible for accurately documenting expenses and providing supporting documentation.

How to Create an Expense Report

Creating an expense report involves documenting business-related expenditures and organizing them in a format that can be submitted for reimbursement or financial tracking.

1. Gather documentation

Gather all receipts, invoices, and supporting documents for the expenses you’ve incurred. Make sure you have accurate and detailed records.

2. Create header and categories

Start the report with a header including your details and reporting period. Create columns for date, category, description, and amount. Group expenses under categories.

3. Calculate totals

Sum up amounts for each category and provide a total. Some tools have formulas for automatic calculations.

4. Attach receipts and review

If you’re using a digital platform, attach digital copies of receipts to the expense report. If submitting a physical report, ensure that all paper receipts are securely attached.

Double-check all entries for accuracy. Make sure that the expenses align with company policies and guidelines. Verify that the total matches the sum of individual expenses.

5. Submit for approval and reimbursement

Submit the report for approval, typically to a manager. After approval, send it to the finance department for reimbursement, including any required additional information.

When to Use Expense Report Templates

Here are some common scenarios where you can use expense report templates:

Periodic reporting: Whether it’s weekly summaries for small teams, comprehensive monthly financial overviews, or quarterly reports for stakeholders, periodic reporting is a staple in financial management. These templates help maintain consistency and accuracy over time, making sure that all expenses are accounted for and analyzed regularly.

Event-based reporting: Some events require a more focused approach to expense tracking. For example:

- Business trips: From airfare to accommodation and meals, tracking every penny spent is vital for budgeting and reimbursement purposes.

- Client meetings: Expenses incurred during these interactions, such as venue bookings or catering costs, need to be meticulously documented to maintain transparency and accountability.

By utilizing expense report templates in these scenarios, organizations can not only save time but also gain better insights into their spending patterns, which is essential for making informed financial decisions.

Who Can Use an Expense Report Template

For project managers, the ability to track and manage expenses efficiently is crucial to maintaining project budgets and ensuring financial accountability. Expense report templates serve as a vital tool in this regard, offering a structured way to record and analyze expenditures.

Employees, business travelers, sales representatives, consultants, small business owners, and nonprofit workers can also use these templates to systematically document costs associated with travel, meals, supplies, and other business activities. The templates also benefit finance and accounting professionals, as well as human resources personnel, by providing a standardized format for processing and reviewing expense reports. In essence, anyone eligible for reimbursement can leverage expense report templates to streamline the documentation and approval process, ensuring accuracy and transparency in financial matters.

What are the Advantage of Expense Report Templates

Consistency and Standardization

Expense report templates offer a standardized format, ensuring consistent recording of essential details such as dates, categories, descriptions, and amounts. This promotes accuracy and streamlines the reimbursement process.

Efficiency and Time Savings

The predefined structure of templates reduces the time and effort needed to create and submit expense reports. Automated calculations expedite total generation, benefiting both employees and those responsible for reviewing reports.

Accurate Record-Keeping

Expense report templates contribute to accurate record-keeping by capturing all relevant details for each expense. This precision is vital for financial tracking, budgeting, and maintaining a thorough audit trail with supporting documentation.

Facilitates Analysis and Decision-Making

The organized nature of templates helps with the easy analysis of spending patterns, helping decision-makers in quickly identifying trends, controlling costs, and making informed decisions about budget allocations and resource planning.

What are the Limitations of an Expense Report

While expense report templates can streamline the process of reporting and tracking expenses, they are not without their limitations.

Prone to human error: Manual data entry in expense reports makes them susceptible to inaccuracies, which can impact financial records and reimbursement processes.

Potential for delay: Expense reports may experience delays in submission and approval, affecting timely reimbursement and accurate financial record-keeping.

Risk of fraud: Manual systems can be vulnerable to fraudulent activities or unintentional misconduct, leading to financial losses for the organization.

Difficulty in tracking non-reimbursable expenses: Distinguishing between reimbursable and non-reimbursable expenses may be challenging, complicating cost tracking and budget management.

Tips for Creating an Effective Expense Report with Creately

Creating an effective expense report template is crucial for streamlining the expense management process.

Incorporate clear categorization of expenses

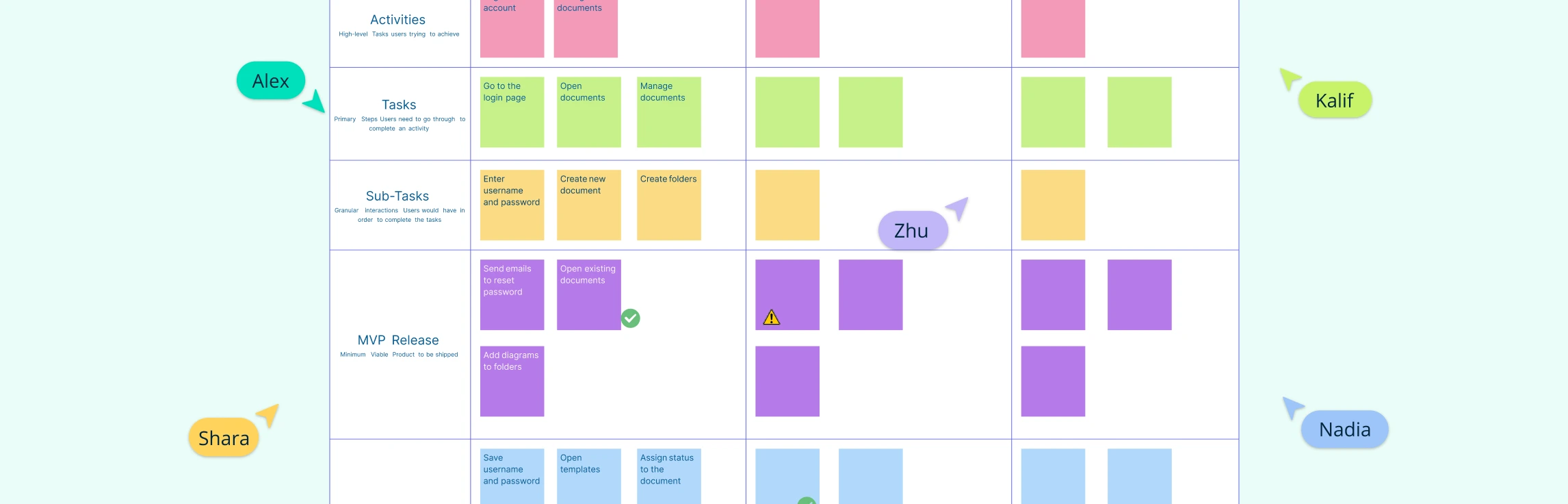

Organize expenses into clear categories such as travel, supplies, and meals. This simplifies the process for users and helps with accurate reporting. Use Creately’s advanced table shape to quickly format your expense report categories. The intuitive table shape allows you to easily merge cells, customize margins and insert shapes within it as you want. You can also use it as a frame and convert it into an action plan or Kanban board where you can easily assign roles, create tasks, and track progress.

Additionally you can also use the interactive whiteboard to visually organize information. Create sections for each expense category and visually represent data using charts or graphs to improve clarity and understanding.

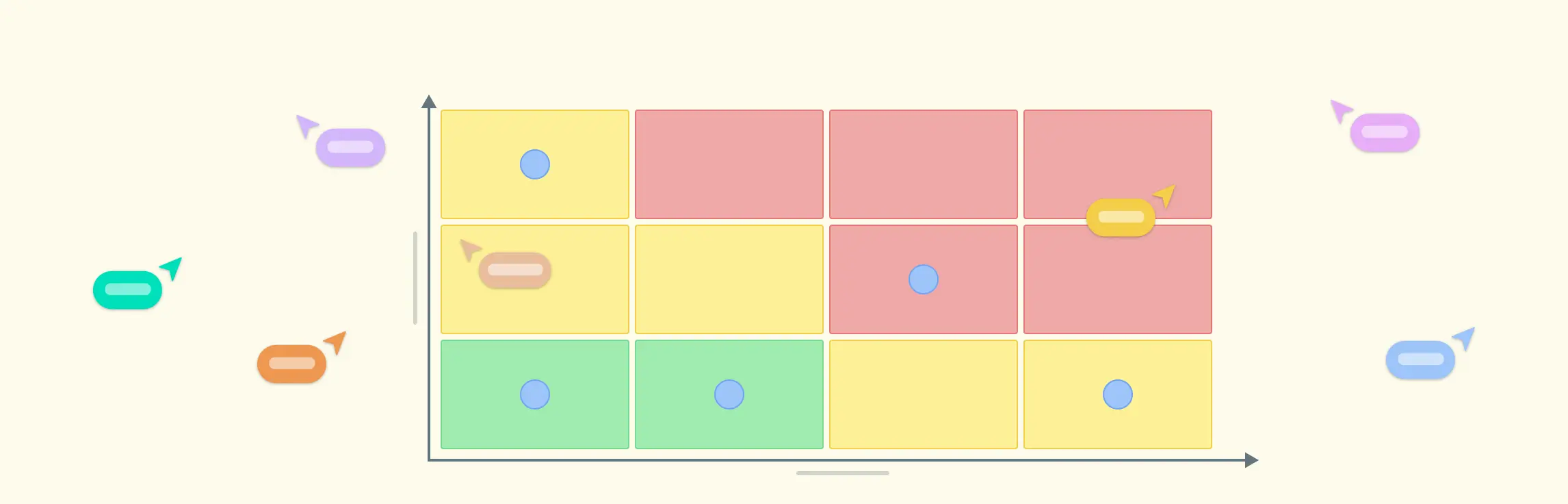

Ensure user-friendly design for ease of use

A well-designed template should be intuitive, allowing users to fill out their reports quickly and without confusion. Consider using Creately’s visual elements like preset color themes for color-coding or icons to make navigation straightforward. Or use Creately’s pre-built expense report templates to streamline the process.

Include fields for necessary documentation

Make sure there are designated areas for attaching receipts, invoices, and other relevant documentation. This helps in verifying expenses and maintaining compliance. You can use the integrated notes panel and the data fields to keep records of the additional data and attachments.

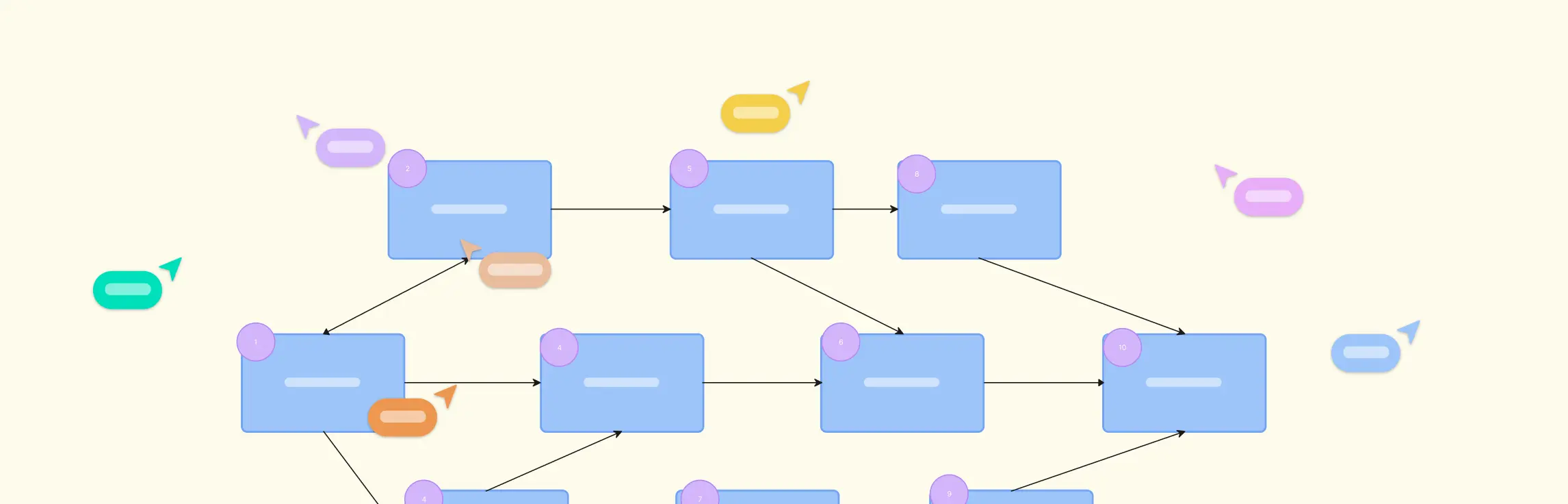

Provide guidelines for consistent data entry

To avoid discrepancies, include instructions within the template that guide users on how to enter information consistently. Use comments and annotations to provide context, clarification, or additional information regarding specific expenses. This improves communication and ensures everyone is on the same page.

Collaborate seamlessly with stakeholders

Leverage Creately’s real-time collaboration to allow team members to work together on the expense report simultaneously. This is particularly useful for multiple stakeholders to provide input and review the report in a collaborative manner. Any changes made to the expense report can be tracked with workspace version history.