Understanding the industry you operate in is crucial for any business. An industry analysis helps you see the bigger picture of your market, recognize the forces at play, and identify opportunities and threats. Whether you’re starting a new business or looking to grow an existing one, conducting an industry analysis can provide valuable insights. In this guide, we will walk you through the steps to conduct a comprehensive industry analysis.

What is an Industry Analysis

An industry analysis is a comprehensive process that helps you understand the market in which your business operates. It involves examining a range of factors that can influence your industry, such as market size, growth rate, key competitors, and overall trends. This analysis considers the economic, social, technological, political, and environmental aspects that shape the industry’s landscape. By delving into these elements, you can identify the strengths and weaknesses of your business, as well as the opportunities and threats present in the market.

Additionally, industry analysis can uncover customer needs and preferences, helping you tailor your products or services to better meet market demand. Ultimately, conducting an industry analysis provides you with a clear and detailed picture of the environment in which your business competes, enabling you to make informed strategic decisions, anticipate changes, and stay ahead of your competitors.

Key elements of an industry analysis,

- Market size and growth: Assess the current market size and its growth trajectory.

- Key players: Identify major companies and competitors in the industry.

- Trends and changes: Analyze current trends and anticipate future shifts in the industry.

- Competitive landscape: Evaluate the intensity of competition and strategic approaches used by competitors.

- Opportunities and threats: Identify potential growth opportunities and risks that could affect business operations.

Understanding these elements enables businesses to position themselves strategically, seize opportunities, and navigate challenges within their industry effectively. An industry analysis provides the foundation for making strategic decisions that can lead to growth and success.

How to Do an Industry Analysis

Follow these steps to gain a thorough understanding of your industry’s dynamics and make informed decisions to drive your business forward effectively.

Step 1: Define your industry

Start by clearly defining the industry or market sector you want to analyze. Specify what products or services are included and whether your focus is local, national, or global.

Step 2: Gather information

Collect data from reliable sources such as industry reports, market research firms, government publications, and trade associations. Look for details on market size, growth trends, key players, and regulatory influences to get a comprehensive view.

Step 3: Identify market trends

Analyze current trends impacting the industry, such as technological advancements, changes in consumer preferences, economic conditions, and shifts in regulations. Understanding these trends helps anticipate future developments.

Step 4: Assess competitive landscape

Study the competitive environment by identifying major companies, their market shares, competitive strategies, strengths, and weaknesses. This analysis helps you understand where your business stands relative to others.

Learn how to do a competitive analysis effectively.

Step 5: Use frameworks for analysis

Apply tools like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) or Porter’s Five Forces (threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, industry rivalry) to evaluate competitive forces and strategic positioning.

Step 6: Evaluate opportunities and threats

Identify potential growth opportunities, such as emerging markets or gaps in the market, as well as threats like new competitors or changes in regulations. Assessing these factors helps in planning strategic responses.

Learn more about the Porter’s Five Forces Model.

Step 7: Forecast future trends

Anticipate future developments in the industry based on current trends and market dynamics. Consider technological advancements, shifts in consumer behavior, and regulatory changes that could impact your business.

Step 8: Draw conclusions and make recommendations

Summarize your findings and insights from the analysis. Based on these insights, develop strategic recommendations for your business to capitalize on opportunities and address potential risks within the industry.

Industry Analysis Methods

The following industry analysis methods provide businesses with comprehensive insights into their competitive landscape, market dynamics, and strategic opportunities, enabling informed decision-making and effective planning for sustainable growth and competitive advantage.

1. Porter’s five forces

Developed by Michael Porter, this framework analyzes competitive forces within an industry that shape its attractiveness and profitability. Porter’s Five Forces helps businesses understand the competitive landscape, assess industry profitability, develop competitive strategies, and anticipate changes in competitive dynamics.

How to use it:

- Threat of new entrants: Evaluate barriers to entry such as high capital requirements, economies of scale, and regulatory barriers that deter new competitors.

- Bargaining power of suppliers: Assess how much influence suppliers have over input prices, quality, and availability.

- Bargaining power of buyers: Analyze the power buyers have to negotiate prices, demand better quality, or switch to alternatives.

- Threat of substitutes: Identify alternative products or services that could potentially replace yours and impact demand.

- Industry rivalry: Evaluate competitive intensity among existing firms based on factors like price competition, differentiation strategies, and market concentration.

2. PESTLE analysis

PESTLE stands for Political, Economic, Social, Technological, Legal, and Environmental factors. It’s a framework that evaluates external macro-environmental factors affecting businesses. PESTLE analysis helps businesses identify external factors impacting their industry, anticipate future trends, assess risks and opportunities, and align strategies with prevailing market conditions.

Learn how to conduct an effective macro environmental analysis.

How to use it:

- Political factors: Analyze government stability, policies, regulations, and political influences impacting business operations.

- Economic factors: Assess economic indicators such as GDP growth, inflation rates, interest rates, and consumer spending affecting market demand.

- Social factors: Evaluate demographic trends, cultural shifts, lifestyle changes, and consumer behaviors influencing product demand and market trends.

- Technological factors: Study technological advancements, innovations, research and development trends, and digital transformation impacting industry operations.

- Legal factors: Consider laws, regulations, compliance requirements, and litigation trends affecting industry practices and business operations.

- Environmental factors: Analyze environmental regulations, sustainability practices, climate change impacts, and consumer attitudes towards eco-friendly products.

3. SWOT analysis

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It’s a strategic planning tool that helps businesses identify internal strengths and weaknesses, as well as external opportunities and threats in the market. Use SWOT analysis to align strengths with opportunities to pursue, address weaknesses that could threaten success, capitalize on identified opportunities, and prepare contingency plans for potential threats.

How to use it:

- Strengths: Identify and leverage your company’s strengths such as unique capabilities, strong brand reputation, or talented workforce.

- Weaknesses: Assess areas needing improvement like high costs, limited market presence, or outdated technology.

- Opportunities: Explore external factors that could benefit your business such as new market trends, emerging technologies, or favorable regulatory changes.

- Threats: Evaluate external challenges like new competitors, economic downturns, changing consumer preferences, or regulatory hurdles.

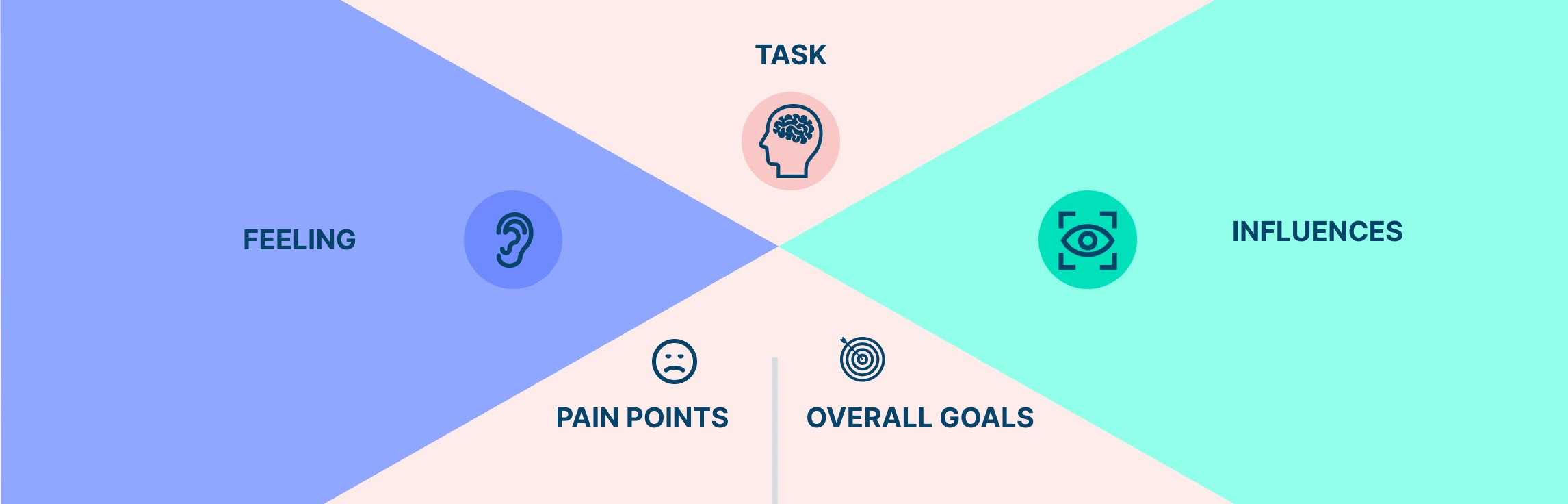

4. Competitive benchmarking

Competitive benchmarking compares a company’s performance metrics, strategies, and practices against industry competitors to identify strengths, weaknesses, and opportunities for improvement. Competitive benchmarking helps businesses understand their competitive position, identify best practices, uncover areas for improvement, and develop strategies to enhance competitiveness and market share.

How to use it:

- Performance metrics: Compare key indicators such as market share, profitability, sales growth, customer satisfaction, and operational efficiency.

- Strategic analysis: Assess competitors’ strategies, product offerings, pricing strategies, distribution channels, and marketing tactics.

- Customer insights: Gain insights into competitors’ customer segments, buying behaviors, brand perceptions, and loyalty programs.

- Operational efficiency: Evaluate competitors’ supply chain management, production processes, cost structures, and technological investments.

5. Trend analysis

Trend analysis examines historical and current market trends, consumer behaviors, technological advancements, and regulatory changes to forecast future developments. Trend analysis helps businesses anticipate market changes, innovate proactively, identify growth opportunities, mitigate risks, and align strategic initiatives with future market trends.

How to use it:

- Historical trends: Study past industry performance, market cycles, and economic trends to identify patterns and drivers of growth or decline.

- Current trends: Analyze current market dynamics, consumer preferences, innovation trends, and regulatory shifts impacting the industry.

- Forecasting: Use trend analysis to predict future market conditions, emerging opportunities, potential threats, and industry disruptions.

- Risk assessment: Identify risks associated with emerging trends, technological disruptions, or changing consumer preferences that could impact business operations.

6. Broad factor analysis

Broad factor analysis considers overarching economic, social, technological, environmental, political, and legal factors influencing the industry at a macro level. Broad factor analysis provides businesses with a holistic view of external influences shaping the industry, helping them understand market dynamics, anticipate changes, and develop strategies to navigate external challenges and capitalize on opportunities.

How to use it:

- Economic factors: Evaluate economic indicators such as GDP growth, interest rates, inflation, and employment trends impacting industry demand and investment.

- Social factors: Analyze demographic shifts, cultural trends, lifestyle changes, and societal values influencing consumer behavior and market preferences.

- Technological factors: Assess technological advancements, research and development trends, digital transformation, and adoption of new technologies driving industry evolution.

- Environmental factors: Consider environmental regulations, sustainability initiatives, climate change impacts, and consumer preferences for eco-friendly products.

- Political factors: Evaluate geopolitical stability, government policies, trade agreements, and regulatory frameworks impacting industry operations and market dynamics.

- Legal factors: Analyze industry-specific regulations, compliance requirements, intellectual property laws, and legal challenges affecting business practices.

7. BCG matrix (Boston Consulting Group)

The BCG Matrix categorizes products or business units based on their market growth rate and relative market share to guide investment decisions. The BCG matrix helps businesses allocate resources effectively across their portfolio, prioritize investments, and manage product or business unit lifecycle strategies.

How to use it:

- Stars: High-growth products or units with a high market share, requiring heavy investment to sustain growth.

- Cash cows: Low-growth products or units with a high market share, generating stable cash flow that can be reinvested in other areas.

- Question marks: High-growth products or units with a low market share, requiring strategic decisions to either invest for growth or divest.

- Dogs: Low-growth products or units with a low market share, typically requiring divestment or restructuring efforts.

8. Perceptual mapping

Perceptual mapping visually represents consumer perceptions of brands or products based on key attributes or dimensions. Perceptual mapping helps businesses understand competitive positioning, identify market segments, and develop targeted marketing strategies to enhance brand perception and market share.

Learn how to use perceptual maps to understand consumer perception.

How to use it:

- Identify Attributes: Determine relevant product attributes or characteristics important to consumers (e.g., price, quality, convenience).

- Collect Data: Gather consumer feedback or survey data to assess how brands or products are perceived relative to these attributes.

- Plot Data Points: Map brands or products on a graph based on consumer perceptions, positioning them relative to competitors.

- Analyze Positioning: Interpret the map to identify competitive positioning, market gaps, or opportunities for differentiation.

9. Strategic group analysis

Strategic group analysis identifies groups of firms within an industry that pursue similar strategies or compete on similar dimensions. Strategic group analysis helps businesses understand competitive rivalry, identify strategic groups, and develop differentiated strategies to gain competitive advantage and improve market position.

How to use it:

- Define strategic dimensions: Identify key strategic dimensions such as pricing strategy, product quality, distribution channels, or target market segments.

- Group firms: Cluster firms based on similarities in their strategic choices and market positioning.

- Compare performance: Assess the performance of firms within each strategic group, identifying leaders, followers, and niche players.

- Strategic insights: Gain insights into competitive dynamics, competitive advantages, and strategic options for positioning within the industry.

Explore more industry analysis templates.

Why is an Industry Analysis Important

An industry analysis is crucial for businesses because it helps them understand the environment they operate in and make smart decisions. Here’s why it matters:

- Understand your competition: it lets you see who else is in the market, what they’re doing, and how you can stand out.

- Spot opportunities and risks: by studying trends and changes, you can find new chances to grow and avoid potential problems.

- Plan better strategies: with a clear view of the industry’s landscape, you can plan how to compete effectively and grow your business.

- Stay updated: it keeps you informed about what’s happening in your industry, so you can adapt to changes and stay competitive.

- Make informed decisions: armed with insights, you can make decisions based on facts rather than guesses, which increases your chances of success.

Conclusion

In conclusion, industry analysis is vital for businesses to deeply understand their market. Using tools like SWOT analysis, Porter’s Five Forces, PESTLE analysis, competitive benchmarking, trend analysis, and broad factor analysis helps businesses make smarter decisions.

These methods identify what a company does well (strengths) and areas needing improvement (weaknesses). They also highlight market opportunities and potential threats. By analyzing these factors, businesses can plan strategies that maximize strengths and opportunities while preparing for challenges.

Industry analysis isn’t just about today—it’s about predicting tomorrow. By staying ahead of trends and understanding their industry’s dynamics, businesses can stay competitive and grow wisely. This knowledge empowers businesses to adapt, innovate, and succeed in a constantly changing business world.